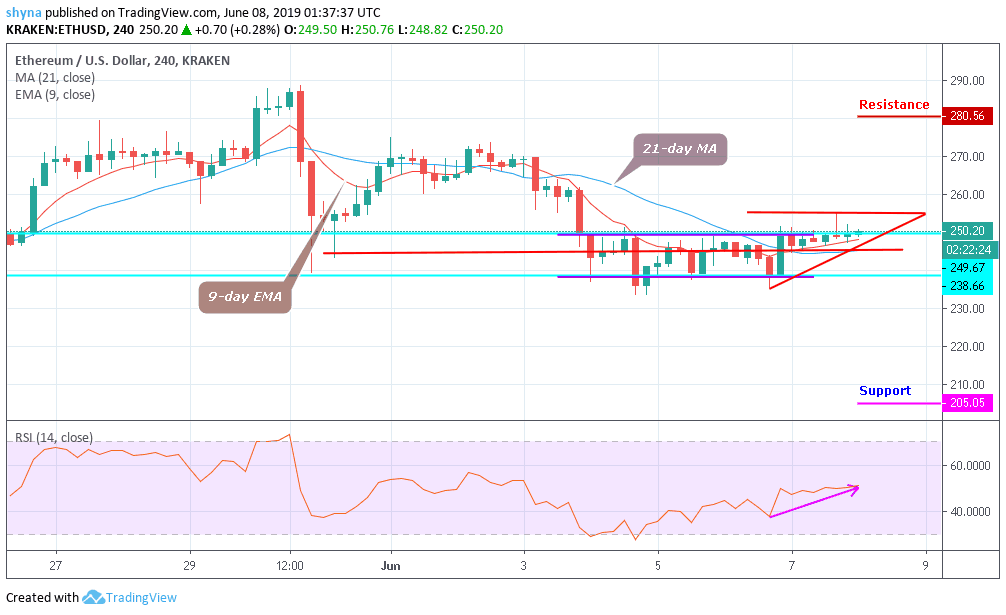

Ethereum Price: Dominant Trend: Ranging

Resistance Level: $280, $300, $320

Support Level: $205, $185, $160

Ethereum is about to start a new uptrend against the fears of a new sale. May 30, Ethereum’s price had reached a maximum of $289.42. On June 2 a peak slightly above $273 was reached. Since then, the price of the ETH has been falling. At the time of writing, its price was negotiated near the channel resistance line. In addition, this resistance line coincides with the long-term market resistance, which slightly decreases, which has been operating since May 30. On June 7, the ETH price reached two respective highs of $252 and $255. During the same period, the RSI generated an average value rate slightly higher than 50. This is known as upward divergence and, often, precedes price increases. The Ethereum price is trading above the 21-day MA and 9-day EMA, which are providing resistance to the price.

In addition, they are about to make a bullish cross above the ascending triangle chart pattern. The use of this makes it likely that the price will leave the range at the time of writing. An increase is likely to appear. The nearest resistance zone is around $260. If the price of ETH continues to increase at the rate provided by the wedge, it should reach that area in the next two or three days. The price of Ethereum has recently increased slightly compared to June 6. Currently, it is negotiating in a horizontal channel in the short term and in a rising wedge in the longer term. Confirming or canceling the trend depends on the level of participation of the scroll bar above $260 and $280. If ETH volumes exceed $280 with increasing volumes, traders can buy the dips with confidence. Conversely, losses below $205 with similar volumes could catalyze a sale at a support level of $160.