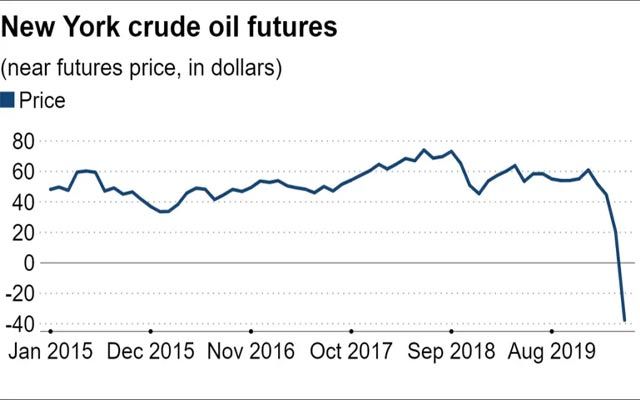

The never seen before Crude oil prices have left not only the Financial markets but also several economies aghast. Bitcoin ended its ‘Bull run’ on Monday, as it fell below the $7k mark. BTC dropped even further today. The day’s range for Bitcoin is $6,774.48 — $6,922.31.

BTCUSD technical analysis

BTCUSD Chart Published on TradingView.com

Here is the four-hour timeframe chart for Bitcoin.

- The large red candles indicate the panic and profit-booking mostly by the retail investors. The large volumes associated with those red candles are also a gloomy sight for BTC investors.

- The crucial support is at $6,793.06. BTCUSD is currently hovering very close to this support. Falling below this support, BTC could drop to $6,568.

- The Relative Strength Index does not seem to provide any relief either. It is more likely that a further drop in BTCUSD might take place soon. The Moving Average indicators point to a ‘strong sell’ in the short term.

Will Bitcoin really go down if Crude keeps falling?

Demand for Crude is indeed decades low. Coronavirus has caused the world to reach a stage that the world has not yet observed ever. It appears that Bitcoin lost its Bull run and fell with the Crude.

However, it is essential to understand that Crude oil has numerous commercial usage. Thus, real demand and real supply are at stake here. But, in the case of Bitcoin, commercial usage is almost negligible. No industry depends on Bitcoin for day-to-day functioning. Therefore, the recent decline of the BTCUSD has more to do with investor panic than with crude oil.

Therefore, there no reason to panic for Bitcoin investors. BTCUSD might fall further, but that will only be due to heavy selling and not directly correlated to crude oil. Considering the current macroeconomic conditions and the high volatility is imperative that investors do not go for unnecessarily risky trades.