Bitcoin Price Key Focuses

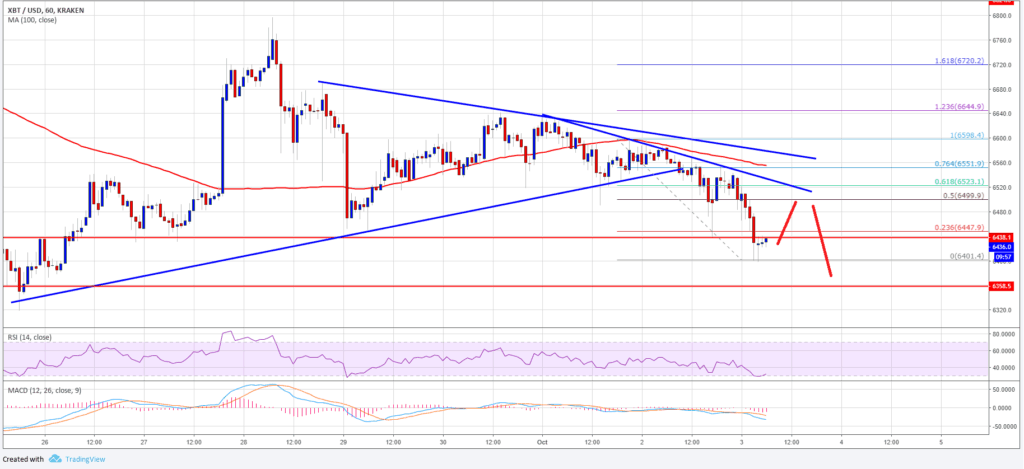

- Bitcoin price broke the $6,540 and $6,520 support levels to move into a bearish zone against the US Dollar.

- Yesterday’s featured critical contracting triangle was ruptured with support at $6,520 on the hourly outline of the BTC/USD pair.

- The pair tried the $6,400 support level and it is as of now redressing higher for the time being.

Bitcoin price broke key supports around $6,520 against the US Dollar. BTC/USD is presently at a danger of more misfortunes towards the $6,360 support.

Bitcoin Price Analysis

Amid the previous two days, we generally observed range moves underneath the $6,700 resistance in bitcoin price against the US Dollar. The BTC/USD pair as of late confronted an expanded offering weight and declined beneath the $6,540 support. Bitcoin price even settled underneath the $6,500 support and the 100 hourly basic moving normal. It appears as though purchasers neglected to pick up footing over the $6,620 level, bringing about a bearish break.

All the more imperatively, yesterday’s featured critical contracting triangle was broken with support at $6,520 on the hourly diagram of the BTC/USD pair. The pair exchanged towards the $6,400 support and framed a low at $6,401. It is at present amending higher towards the 23.6% Lie retracement level of the ongoing drop from the $6,598 high to $6,401 low. It might maybe keep on moving higher towards the $6,500-6,520 zone, which is probably going to go about as a resistance. It additionally speaks to the half Lie retracement level of the ongoing drop from the $6,598 high to $6,401 low. Plus, there are two associating bearish pattern lines set up with resistance close $6,520.

Taking a gander at the diagram, bitcoin price may adjust higher for the time being, yet the past support at $6,520 could avert gains. On the drawback, a break beneath the ongoing low at $6,401 may drive bitcoin price towards the $6,360 support.

Taking a gander at the technical markers:

Hourly MACD – The MACD for BTC/USD is back in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI is presently close to the 30 level.

Significant Support Level – $6,400

Real Resistance Level – $6,520