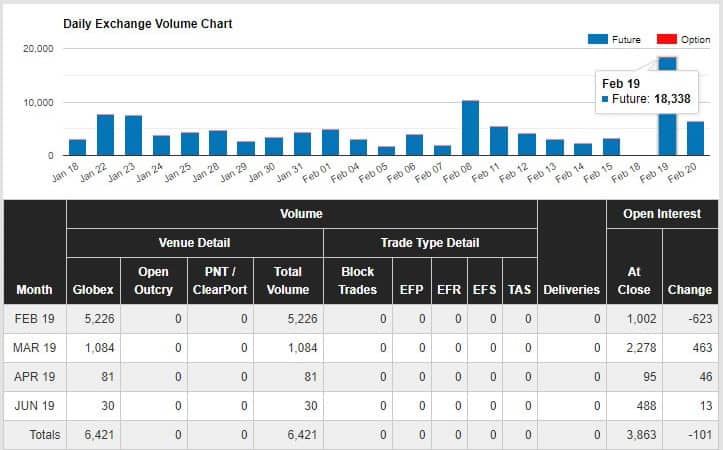

These days saw the highest and rapid increase ever for Bitcoin futures on the Chicago Mercantile Exchange as the amount exceeded 18,000. Institutional investors are paying attention to this as the bitcoin future contracts get snapped up at an ever-increasing rate.

Record of BTC Contract Size on CME:

As per the stats of CME they were 18,338 on Wednesday, which is the highest figure ever recorded till now. This is equivalent to 91,690 Bitcoins or roughly $365 million at today’s prices.

Upcoming contracts enable explorers to bet on the prices rather than to purchase the physical assets. So these figures might be a little misleading.

When the new product which offers the physically settled contracts hit the market, they will be paying out in BTC which will drive tremendous momentum for crypto markets. Over the past year or so the expectation of a crypto Exchange Traded Fund (ETF) being launched has been telecasted and dominated the news. The year 2018, has been the year of regulation and cooling off which was only to be expected after the previous year of rampant FOMO and parabolic market action.

This year 2019, is expected to be different as many industry experts predict the launch of at least one institutional investment vehicle.

As per the Block European exchange giant, Eurex is preparing to launch crypto and bitcoin futures so the list of institutional offerings is increasing rapidly. The cognate exchange is operated by Germany’s Deutsche Börse, which will be offering Bitcoin, Ethereum and XRP imminently according to the report.

Exchange traded funds are the future:

In addition to these future products, there is already one type of Exchange Traded Funds that are actually traded through an ETN (exchange-traded note) which allows investors to get direct exposure to Bitcoin prices. The Grayscale Bitcoin Trust (GBTC) crosses the technicalities of buying and storing Bitcoin but still allows investors to get into the action by buying shares that trade at around a thousandth of the price of BTC.

GBTC has been highly popular with over $800 million which is already invested in the Bitcoin fund.

Furthermore, Bitcoin is the most popular. The fund eliminates the volatility of buying and owning Bitcoin directly which is something that institutions want.