A Stunning History of Bitcoin’s High points and low points

A standout amongst the most well known memes on the cryptocurrency subreddit r/bitcoin, apparently the biggest centralization of Bitcoin aficionados on the web, delineates a toon coin riding a thrill ride with its hands waving fiercely noticeable all around. On days when Bitcoin is soaring in price, the image demonstrates the rollercoaster propelling straight upward, and on days when Bitcoin is crashing, the amusing copy is seen bearing a close vertical drop. This double sided web joke has went with almost every critical development in Bitcoin’s price lately and is telling in its recurrence.

Bitcoin is interminably rising and falling in relative fiat esteem, and even mid 2018’s 70% decline isn’t surprising, nor is it the most noticeably bad at any point saw. Indeed, even in the midst of the most sickening of freefalls, experienced traders remain courageous, on the grounds that they’ve been there previously. Holding through a correction is just about a transitional experience for cryptocurrency investors, and the gathering’s most experienced veterans have persevered through more than what’s coming to them throughout the years.

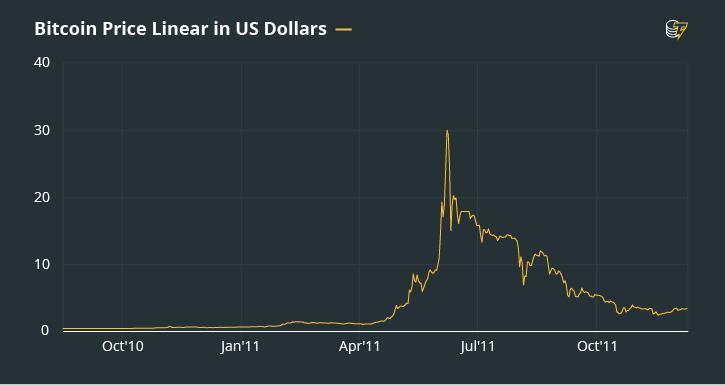

June 2011

The beginning of Bitcoin were its ‘Wild West‘— a period when not very many exchanges made exchanging conceivable, and when just the most courageous of the overcome dunked their toes in. Such conditions were everything except kept from liquidity, thus when the price started rising from around $0.95, the slope and the accompanying drop were a portion of the steepest at any point recorded.

In mid-June 2011, Bitcoin’s price come to as high as $32.00 per coin before tumbling the distance to $2.00 in November. At a 94% decline, this crash still keeps up its record and holds excruciating recollections for early investors, however the individuals who held solid are currently checking their fortunate stars (and wads of bills). Thinking back, this twofold digit unequaled high appears to be low, yet one must recollect that there was a small amount of the present volume and intrigue. Bitcoin was as yet a to a great extent obscure idea try, and nobody had any sign of its future. In like manner, $32 appeared like a decent time to take benefit, particularly after such a spike, and different traders started to surrender.

January 2012

The second critical crash happened a very long time after Bitcoin bottomed out at $2.00 per coin. In spite of the fact that the price had dramatically increased from lows before the finish of 2011, the market was as yet dreadful, as it had viewed the cryptocurrency tumble from $32.00 just as of late.

Beginning the year at a hopeful $4.50, Bitcoin expanded in January to over $7.00. Be that as it may, plunge purchasers today should look to this time and observe, as it embodies a vital reality: Bitcoin isn’t ensured to achieve its past untouched high before redressing afresh. From around $7.40, it took an unnerving 49% decline to only $3.80 in late January, shaking out a few investors who had held through November’s failure.

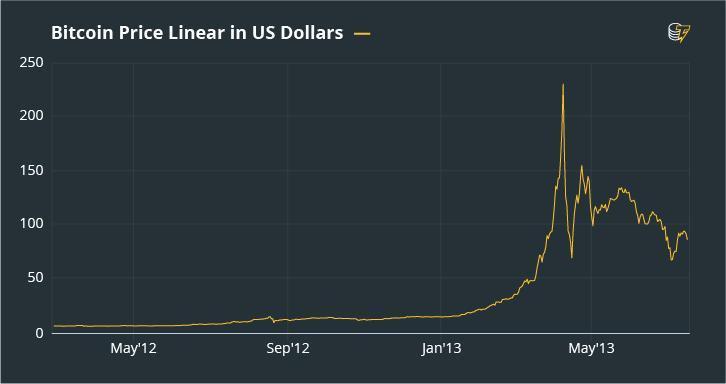

April 2013

The period between mid 2012 and 2013 was uneventful. Bitcoin picked up consistently and started 2013 at a price of around $13.00, coming to as high as $17.00 in 2012. Mid 2013 was a bullish stage for the cryptocurrency, as it pushed past its unequaled high of $32.00, achieving $49.00 before a one-day minor correction back to $33.00.

Numerous new exchanges and traders, notwithstanding extended media scope helped Bitcoin recuperate rapidly, and it put on gains at a hot pace until April, where bulls at long last abdicated at a price of $260.00, breaking admirably into the triple digits. A blackout at the then most famous exchange, Mt. Gox, was likewise credited as driving force for the decline. Benefit bringing transformed into an all out freefall down to $40.00, for an aggregate loss of 83%.

November 2013

Known as the greatest and most excellent of Bitcoin crashes, it’s nothing unexpected that the scandalous 87% decline occurred in November 2013. As the most recent development to $20,000.00 demonstrated, Bitcoin bull runs tend to turn into a craze late in the year. The same number of anticipated, November to January 2014 is a close identical representation of the most recent four months, with an enormous convergence of new traders and media consideration helping bitcoin achieve inconceivable highs.

In late 2013, the price was nearing $1,200.00—a mentally critical price that helped the resulting rot keep going for quite a long time. With an aggregate of 411 days in correction, helped to a limited extent by the epic implosion of Mt. Gox and deletion of nearly $500 million, the post-November low was just come to in January 2015 at about $150.00.

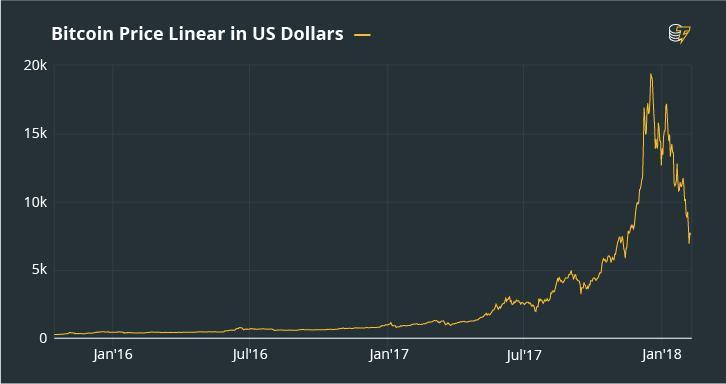

November 2017

Five years on the dab after Bitcoin’s four-figure make a big appearance, the lord cryptocurrency soar past the five-figure stamp at $10,000.00 and drove the distance to $20,000.00 before losing steam. The two years’ earlier would turn out to be a portion of the best chances to purchase, and even the individuals who bought bitcoin at the year’s opening price of $750.00 picked up essentially.

In December, a little correction down to $14,000.00 wasn’t sufficient to stop energy, which rapidly took it back to $17,000.00 before separating. Worries about Bitcoin’s manageability, particularly with a plenty of noteworthy elective arrangements being discharged, just made the selloff more extraordinary. Support rose close $5,900.00—the mid-to-late 2017 level when the cryptocurrency evaluating started showing a close exponential ascent. An aggregate decline of more than 70% could go lower, if 2013 is anything to pass by, yet markets are hopeful for 2018.

Looking Forward

On the off chance that anything, this long history of rehashed blast and bust is a hopeful flag. When Bitcoin entered the features, it never left, and it keeps on snowballing in notoriety with retail investors and media consideration the more it remains important. All through administrative weights, technical challenges, and numerous a larger number of corrections than the ones featured over, the cryptocurrency has stayed at the front line of the Blockchain upset.

Bitcoin’s destiny is fixing to more than its adherents, in any case, and the multi-year battle that happened post-2013 exhibits that the way back upwards isn’t in every case straight. With its whales making waves at whatever point they like, miners scanning for different approaches to benefit, and another prospects market, Bitcoin’s viewpoint remains anything besides straightforward after Yesterday’s sudden market crash.