Ripple Price Key Features

- Ripple price declined facilitate as of late and broke the $0.2650 support against the US dollar.

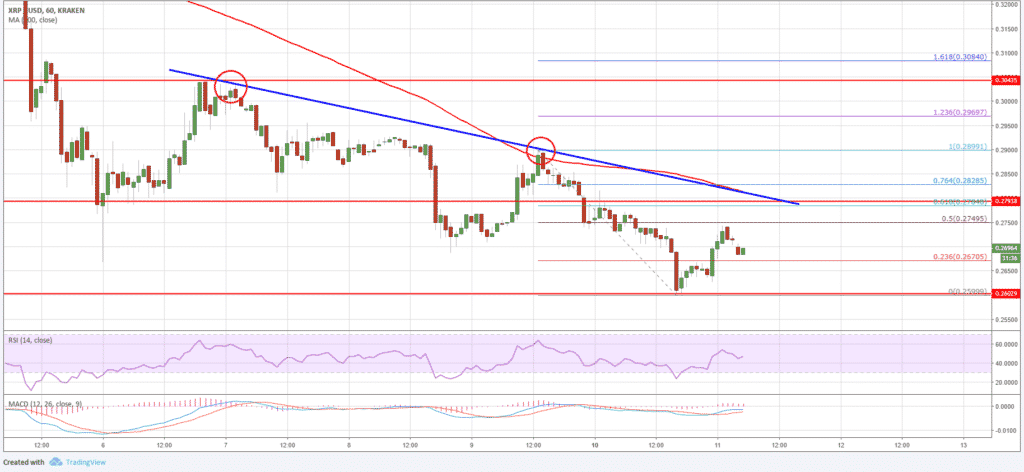

- Yesterday’s featured major bearish pattern line is dynamic with resistance at $0.2800 on the hourly graph of the XRP/USD pair (information source from Kraken).

- The pair may adjust a couple of focuses, however it is probably going to confront dealers close to the $0.2800 and $0.2820 levels.

Ripple price stays in a bearish zone against the US Dollar and Bitcoin. XRP/USD is probably going to expand decays beneath $0.2600 if dealers stay in real life.

Ripple Price Decrease

Recently, we talked about that Ripple price could break the $0.2650 support zone against the US Dollar. The XRP/USD pair moved lower and broke the $0.2700 and $0.2650 support levels. Another week by week low was shaped at $0.2599 and later Ripple price amended higher. It moved over the 23.6% lie retracement level of the ongoing decay from the $0.2899 high to $0.2599 low.

Be that as it may, the upside move stays topped close to the $0.2750 level. It is the half lie retracement level of the ongoing decay from the $0.2899 high to $0.2599 low. All the more essentially, yesterday’s featured major bearish pattern line is dynamic with resistance at $0.2800 on the hourly outline of the XRP/USD pair. The pattern line resistance is additionally close to the 100 hourly basic moving normal at $0.2820. In this manner, if ripple price revises above $0.2750, it is probably going to confront dealers close to the $0.2800 and $0.2820 levels. On the drawback, a break underneath the $0.2600 zone could open the entryways for a push towards the $0.2500 support.

Taking a gander at the outline, ripple price stays in a negative zone underneath $0.2820. Venders are probably going to stay in real life insofar as there is no nearby above $0.2850 and the 100 hourly SMA.

Taking a gander at the technical pointers:

Hourly MACD – The MACD for XRP/USD is marginally put in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is as of now beneath the 50 level.

Significant Support Level – $0.2600

Significant Resistance Level – $0.2800