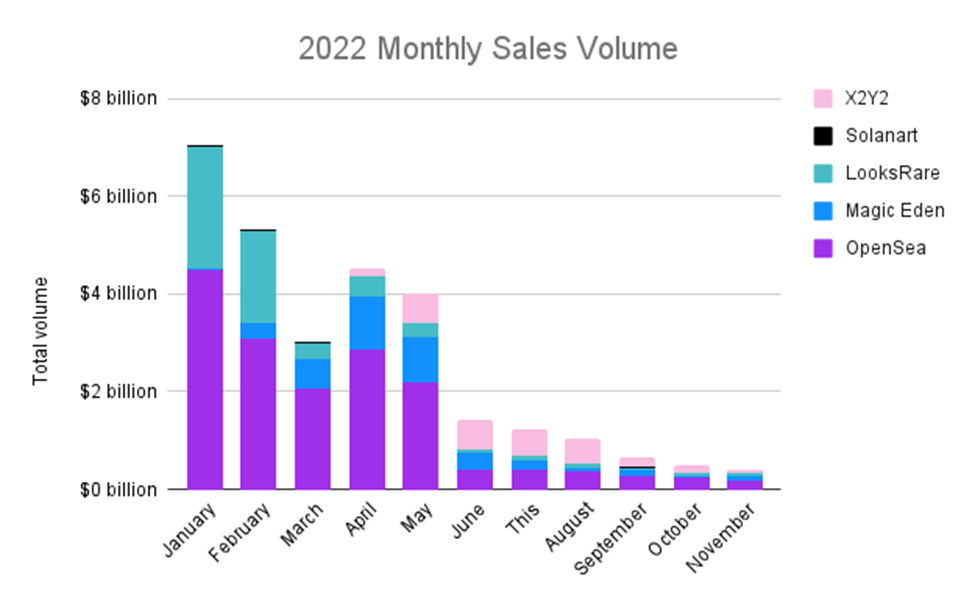

The total volume of non-fungible tokens sold across the top five marketplaces in November came in at approximately $394 million. The lowest amount is seen so far this year.

The volume on OpenSea, Magic Eden, X2Y2, LooksRare, and Solanart decreased by more than 20% compared to the previous month of October, according to data provided by DappRadar and collated by the NFT gaming platform Balthazar DAO.

At the beginning of November, the failure of a large exchange called FTX rattled people's faith in digital assets, rocking spot market values. This continued the downward trend that had been going on since October.

According to Balthazar (1), the selection of marketplaces was based on which had the biggest total volume ever recorded. Requests for comments were not immediately responded to by representatives of any of the five marketplaces.

Magic Eden, the sole outlier of the five recorded platforms and Solana's largest marketplace, was able to weather the storm, as seen by a month-over-month increase in sales volume of 60.9%.

Surprisingly, the least popular NFT marketplace situated in Solana, known as Solanart, was the one that was negatively affected the most out of the top five, seeing its revenue drop by 93% from $6.25 million in October to only $410,000 by November (3).

John Stefanidis, CEO and co-founder of Balthazar, is optimistic about the fledgling technology despite total sales going down. The technology began to take off in earnest near the end of the previous year.

He said, "What we've seen is definitely a reduction in sales mostly for...pictures and art, but what we're starting to see is very creative and diverse applications of NFTs. What we've seen is certainly a decline in sales for photos and art."

People's decisions to wait for future NFT use cases were influenced by macroeconomic reasons such as rising interest rates, shrinking disposable incomes, and volatile market conditions, according to Stefanidis, who also noted that this ultimately translated into fewer sales.

The change in market attitude that occurred after a historic spike in late 2021 and early 2022, during which time the value of the entire NFT sector was over $40 billion, has also had an impact on the market share of some of the industry's most important firms.

Analysis of Market Shares of Major Players

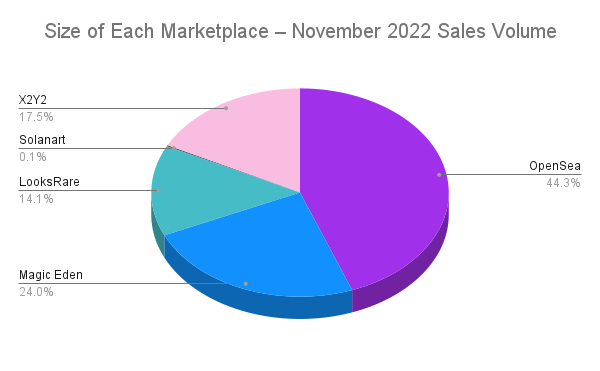

Marketplace In comparison to the previous month, OpenSea saw a decrease in its market share of 1.6 percentage points during November. The company had previously found success by capitalizing on its early mover advantage. According to data compiled by DappRadar and Balthazar, it continues to hold a commanding lead of 44%.

In the meantime, Magic Eden and LooksRare increased their market share by 12.1 and 2.5 percentage points in November to take a larger portion of the month's total sales volume.

To begin the month of December, the number of one-of-a-kind active wallets connecting with each of the five platforms has dropped significantly. In the first few days of this month, OpenSea saw a decrease in user activity of approximately 47%, while Magic Eden decreased by approximately 12.5%.

The last four days have seen a decline of 25% in Solanart's UAW, while LooksRare and X2Y2 have had declines of 41% and 64%, respectively. These results suggest a sluggish beginning to the final month of the year.