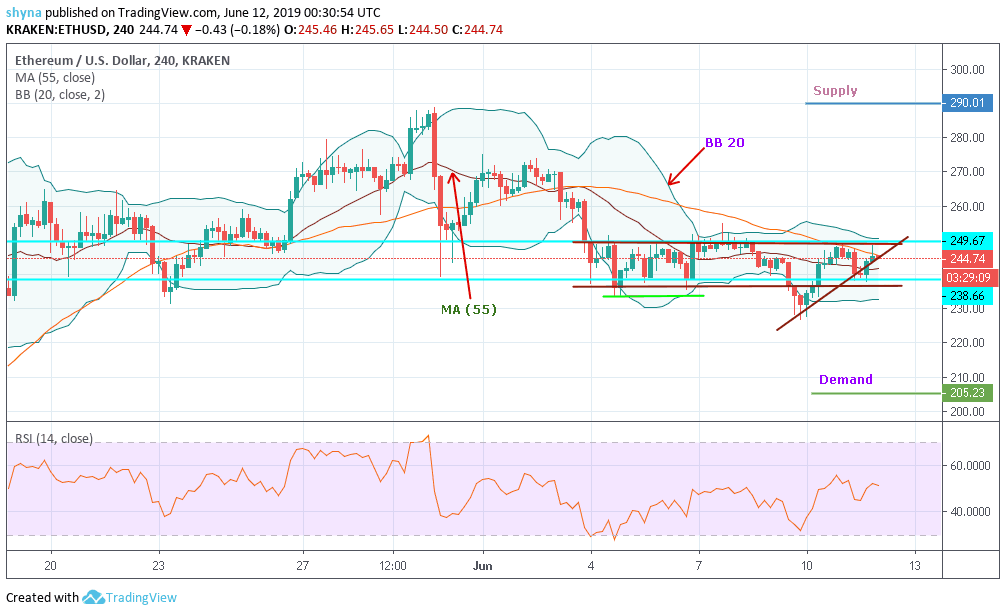

ETHUSD Dominant Trend: Ranging

Resistance Levels: $290, $300, $310

Support Levels: $205, $195, $180

Ethereum Price Analysis

Currently, the Ethereum Price is moving sideways and the cryptocurrency is trading at $244. Ethereum price is below the 55-day moving average, which indicates a downward trend by Ethereum. For the time being, the cryptocurrency quotes are moving towards the lower edge of the Bollinger Band indicator. Meanwhile, we expect an attempt to continue the increase in Ethereum price and the development of the uptrend. The purpose of this move is to provide near the $290 supply level. The conservative supply level for Ethereum’s purchases is close to the lower limit of the Bollinger Bands indicator at a demand level of $180. Any attempt by the buyers to cancel the option is to continue reducing the Ethereum rate, which would be equivalent to eliminating the demand from the lower edge of the Bollinger band indicator.

However, after exceeding the lower edge of the Bollinger Band indicator, this will also affect the moving average with a period of 55 days and the closing of the market price below the demand level of $205. This will indicate a change in the current downward trend of ETH/USD. In the event of an interruption in the upper limit of the Bollinger Bands indicator, an acceleration of the currency increase is expected, which implies a supply level of $280 or more. The area reserved for the purchase of Ethereum is available at a price of $310. By canceling the increase option, the Ethereum price will be a breakdown of the demand level of $180. In this case, we can expect more purchases since the RSI 14 signal is moving towards the overbought territory.