Bitcoin Price Key Focuses

- Bitcoin price is draining and it could broaden its slide underneath the $6,100 level against the US Dollar.

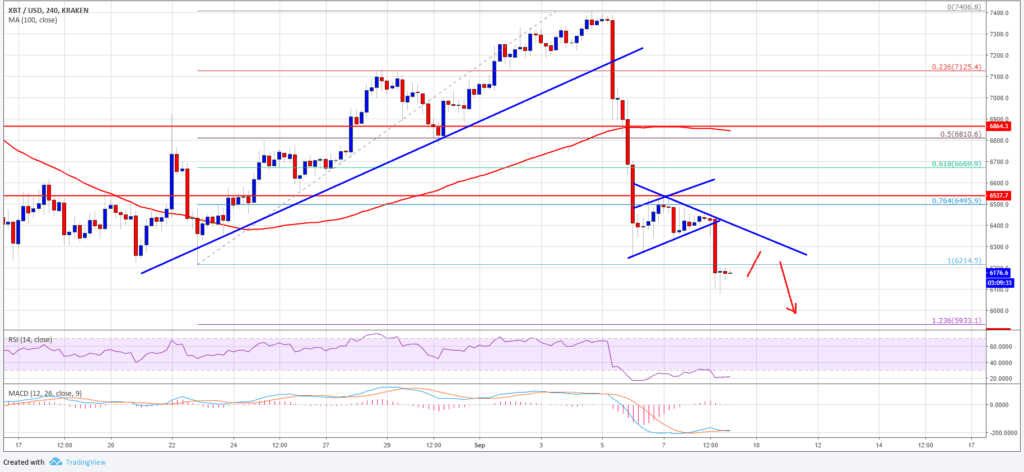

- There is an associating bearish pattern line set up with resistance at $6,300 on the 4-hours outline of the BTC/USD pair (information feed from Kraken).

- The pair is unmistakably under strain and it might maybe slide to $6,000 and $5,950 in the close term.

Bitcoin price as of late broke the $6,214 swing low against the US Dollar. BTC/USD is probably going to broaden decreases and it could spike underneath $6,000 if merchants stay in real life.

Bitcoin Price Pattern

This previous week, bitcoin price began a noteworthy drawback move from well over the $7,200 level against the US Dollar. The BTC/USD pair broke numerous supports in transit down like $7,200, $7,000, $6,750, $6,600 and $6,400. There was likewise a break underneath a noteworthy bullish pattern line with support at $7,200 on the 4-hours graph. The decrease was with the end goal that bitcoin price even broke the $6,214 low and settled underneath the 100 basic moving normal (4-hours).

As of late, bitcoin price broke a bearish banner with support at $6,400 to broaden slides. It tried the $6,100 support and it is as of now combining over the $6,150 level. It appears as though it could amend a couple of focuses, yet the $6,300 level is probably going to go about as a solid resistance. There is additionally an interfacing bearish pattern line set up with resistance at $6,300 on the 4-hours outline of the BTC/USD pair. Over the pattern line, the past support close $6,500 is the following significant resistance. On the drawback, bitcoin price could test the 1.236 Lie expansion level of the last real wave from the $6,214 low to $7,406 high.

Taking a gander at the graph, Bitcoin price is plainly in a downtrend, yet the $6,000 and $5,950 support levels could give a solid base to a recuperation.

Taking a gander at the specialized markers:

4-hours MACD – The MACD for BTC/USD is gradually moving back in the bullish zone.

4-hours RSI (Relative Strength Index) – The RSI is still well underneath the 30 level.

Real Support Level – $6,000

Real Resistance Level – $6,500