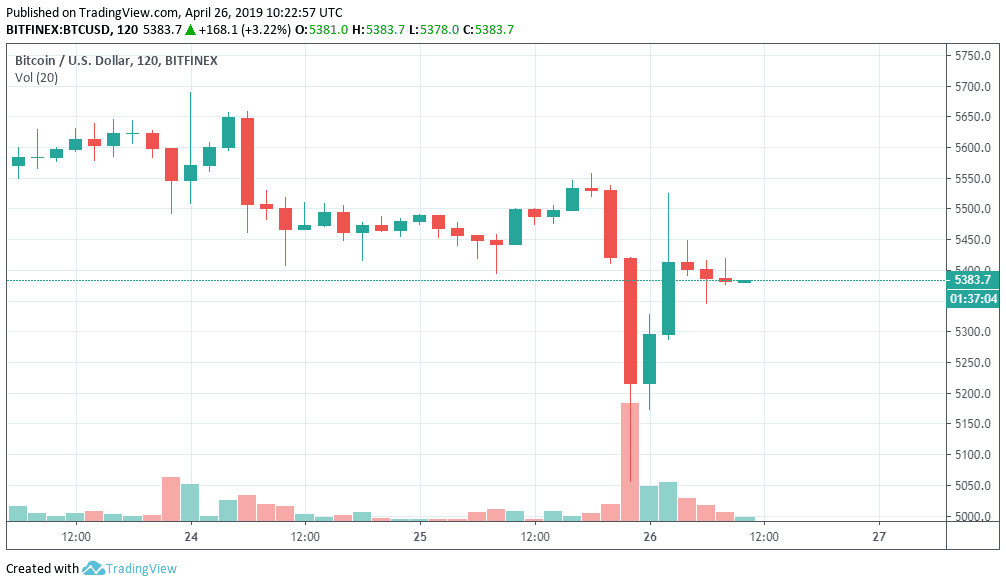

The bombshell news that is certainly responsible for the price crash of bitcoin and other cryptocurrencies is that Bitfinex has been accused by the New York attorney general of an $850 million coverup to hide the apparent loss of hundreds and millions of dollars of clients and corporate funds.

Bitfinex and Tether responsible for Bitcoin Price Crash?

Apparently, Bitfinex sent $850 million of customers and corporate funds to a payment processor called Crypto Capital Corporation who is said to also be holding funds from other exchanges as well which includes QuadrigaCX. According to CryptoCapital and representatives for Bitfinex and Tether, the reason that the $850 million is inaccessible is that the Portuguese police and American government officials have seized the funds.

In response to the $850 million getting frozen, funds from Tether’s reserves were used by Bitfinex to make up for the shortfall but unsurprisingly neither the loss or nor Tether’s fund’s movements were disclosed to customers. The executives at Bitfinex made a series of conflicted corporate transactions in which Bitfinex gave itself access to up to $900 million of Tether’s cash reserves.

The paradise papers leaked a few years ago revealed who the true team behind Tether was, something that was previously hidden from the public. The papers revealed that the executive team of Bitfinex and the executive team of Tether are the same.

Now at least $625 million of Tether’s customer funds have been swapped over without their knowledge and they put up 60 million Bitfinex shares as security with CryptoCapital. The interesting thing here is that until all of this happened, Tether may have actually been backed 1:1 by the USD but the Bitfinex crypto capital seizure essentially meant that Tether had to change from being backed by cash to being backed by assets and debt to Bitfinex instead. So basically, Bitfinex borrows hundreds and millions of dollars from Tether which it owns and it pays interest to Tether (the company) which it owns and is pledging 60 million Bitfinex shares to collateralize its loans to itself using customer’s money.

The Real issue:

Keeping it real though, if Bitfinex does actually continue to turn profits, then all of this won’t really be a big problem and CryptoCapital will at some point release those $850 million of funds. However, the issue here is the disclosure. The real concern as always with Tether has been the incredible lack of transparency in the general disregard with which Tether and Bitfinex treat the crypto community.

This monster continues to surface every few months and anyone can look at Tether and realize how dishonest they have been. They have been completely non-transparent in their dealings with the community. There have been no real audits despite the promises for audits. There was the time that the accounting firm made an audit where the main line of that audit said that “this is not an audit”. Then there was the time when Tether got some lawyers to say that they had seen the financials and that it was all good, however, it was still not an audit.

Unsurprisingly, the market is highly affected by such activities. What are your thoughts on Tether and Bitfinex? Tell us in the comments section below.