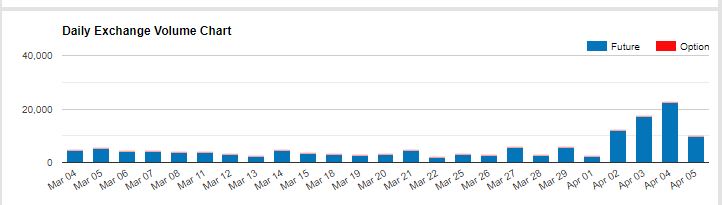

According to data, the Chicago Mercantile Exchange or CME Bitcoin futures suggest that the Wall Street has a noteworthy part in the total Bitcoin futures market as the volume of bitcoin futures traded on 4th April is around $563 million in comparison to the top ten cryptocurrency exchanges which traded around $685 million.

CME bitcoin futures experiencing enormous volumes:

The CME bitcoin futures have been experiencing a massive amount of trading volumes since the Chicago Board Options Exchange or CBOE has decided to delist bitcoin futures from its exchange.

The participation of large stock exchanges in the cryptocurrency derivatives is surely going to be beneficial for the overall cryptocurrency industry in terms of liquidity and regulations point of view.

According to research by Messari Crypto, a crypto research firm, CME experienced around $563 million in bitcoin futures trading volume on 4th April 2019 which is massive.

Wall Street playing a major role in the bitcoin market:

According to Mati Greenspan, cryptocurrency analyst at eToro exchange platform, although the contracts traded on Wall Street are on paper and not settled physically with BTC, still they are a major role in the overall market now.

CME launching Micro E-mini futures contracts:

The Chicago Mercantile Exchange is also planning to launch Micro E-mini futures contracts after achieving success in terms of bitcoin futures. According to recent reports, the Micro E-mini futures contracts shall be launched as soon as May 2019 and major markets such as S&P 500, NASDAQ 100, Dow and Russell 2000 shall be ready for trading.

The Micro E-mini futures contracts shall be a 1/10th size of the indexes they represent which shall enable the user in controlling larger amount futures contracts at similar pricing. The users shall also be able to exit at more than one profiting targets allowing them to scale out.

Even after the CBOE delisted the bitcoin futures from its exchange, the overall BTC futures market seems to be achieving heights in terms of adoption and growth.